TurboTax Self-Employed will walk you through those deductions and ask you specific questions in order to bring your tax bill down. This includes things like your vehicle mileage, cell phone plan, auto loan interest, and more. Once you’ve entered your rideshare income, you’ll want to find as many deductions based on your operating expenses as possible. TTSE has many options to make locating expenses easier.

#Lyft turbotax discount code 2016 drivers#

Example of Uber’s 2019 tax summaryĪ lot of drivers get confused by the fact that Uber and Lyft report your gross income but, if you follow our tax guide, you’ll know that all you have to do is deduct your Uber fees, tolls and commissions (included on your 1099 summary) to make sure the net income is exactly what Uber paid you for the year. It’s important to note that even if you drove part-time for Uber and have a normal job with a W-2, you will still need to use this version of TurboTax in order to file a Schedule C.

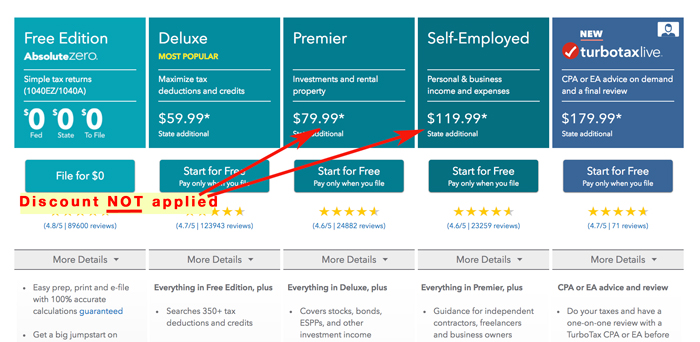

It can also handle all of your personal, property and investment-related taxes. Also, if you drive for multiple services, you’ll be able to input multiple 1099s. If you’ve ever used TurboTax, then the ‘Self-Employed’ version is very similar, but it can also handle all of the business-related deductions that you will want to take from driving. In This Article What Is TurboTax Self-Employed? We’ve been testing it out over the past few weeks and found it makes filing taxes pretty painless, and has some cool features like SmartLook (Live Help) and bank account syncing via ExpenseFinder ™ that make it stand out from its competitors. So if you drive for Uber or Lyft or deliver for Postmates or DoorDash, this is the product you may want to use. The best version of TurboTax for rideshare drivers is TurboTax Self-Employed since it’s tailored towards independent contractors. If you end up using our link, you’ll get a discount on whichever program you choose to use. This year, we’ve partnered with TurboTax and QuickBooks Self-Employed to walk you through the filing process. 👉 Your two most important tools during tax season: Turbotax to file your taxes and a mileage tracking app to keep track of your miles! And if you want to use a TurboTax alternative, check out FreeTaxUSA or Keeper Tax. Our previous surveys have shown that 54% of our readers “self-file” their rideshare taxes, and many of them use online filing services to do so.

#Lyft turbotax discount code 2016 driver#

Today, RSG senior contributor Christian Perea takes a look at TurboTax Self-Employed, one of the top options if you’re looking to self-file your taxes and reviews how it works, how much you can save and more!ĭealing with taxes as a rideshare driver can seem intimidating, but it doesn’t have to be.

0 kommentar(er)

0 kommentar(er)